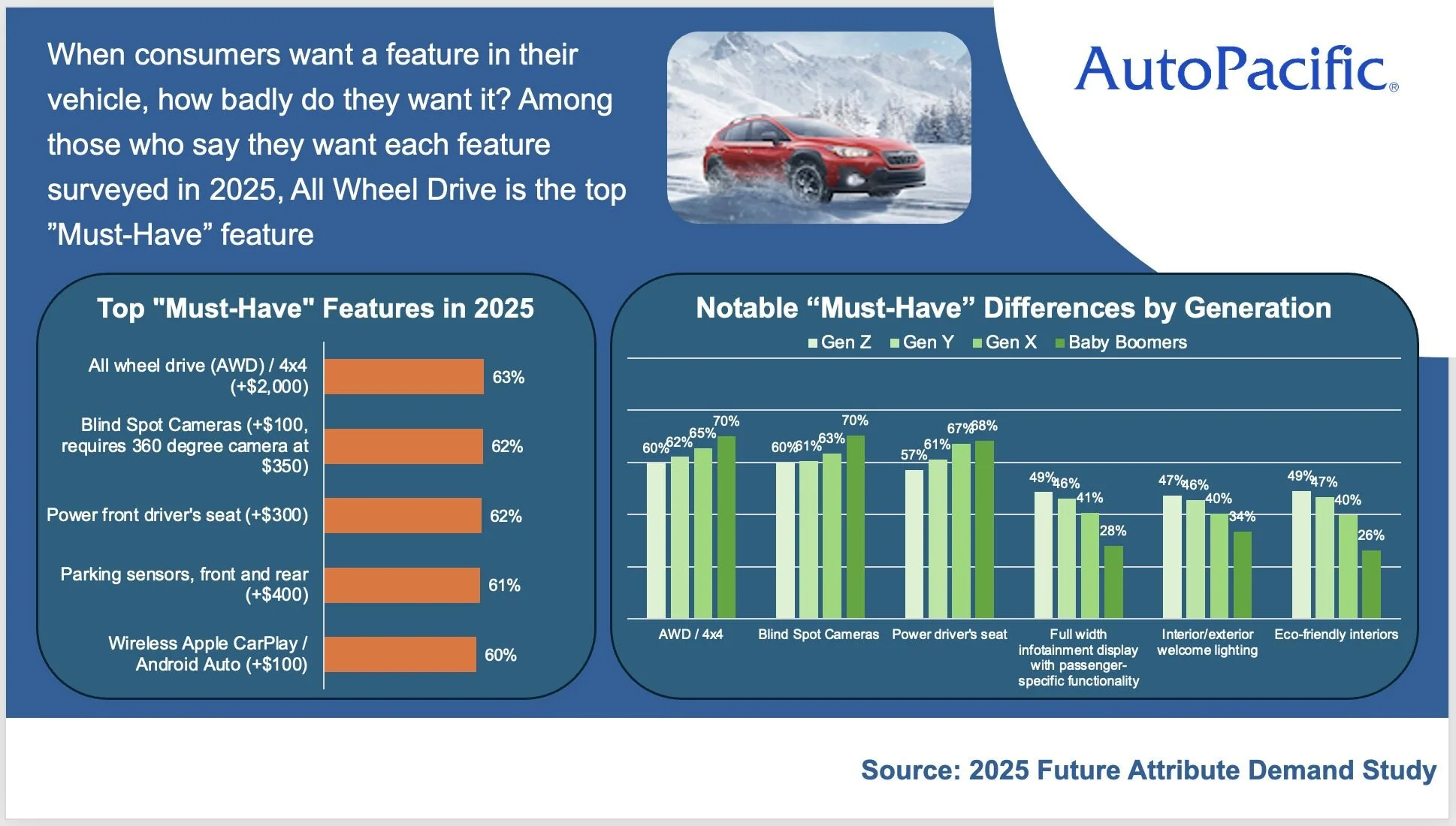

BY: ED KIM, PRESIDENT AND CHIEF ANALYST

It’s no secret that EVs are having a rough go in the U.S. market at the moment. The Trump 2.0 administration oversaw the early elimination of the Federal tax credit on EV purchases, which resulted in the effective price of EVs jumping by thousands on October 1, 2025. To add to the pain, the Trump Administration imposed hefty tariffs on imported vehicles and parts, further adding to EVs’ pricing challenge.

As one would expect, EV sales have tanked since October 2025. The massive EV discounts and lease deals of the last several years are mostly gone, with Q4 2025 EV sales down a whopping 46% over Q3 2025. AutoPacific is forecasting an EV market share dip to 7% in 2026, marking the very first expected annual drop in EV market share since 2011, when the very first mass-produced EV, the Nissan Leaf, went on sale.

It would be easy to simply blame EVs’ woes in the U.S. market on the Republican Party, but there’s a lot more to the story here, especially when really digging into what makes new vehicle shoppers tick. While Republican policies have certainly dealt a major blow to EV adoption in the U.S. market, Republican shoppers may actually have a much bigger role in EV adoption growth from here on out. Wait, what?

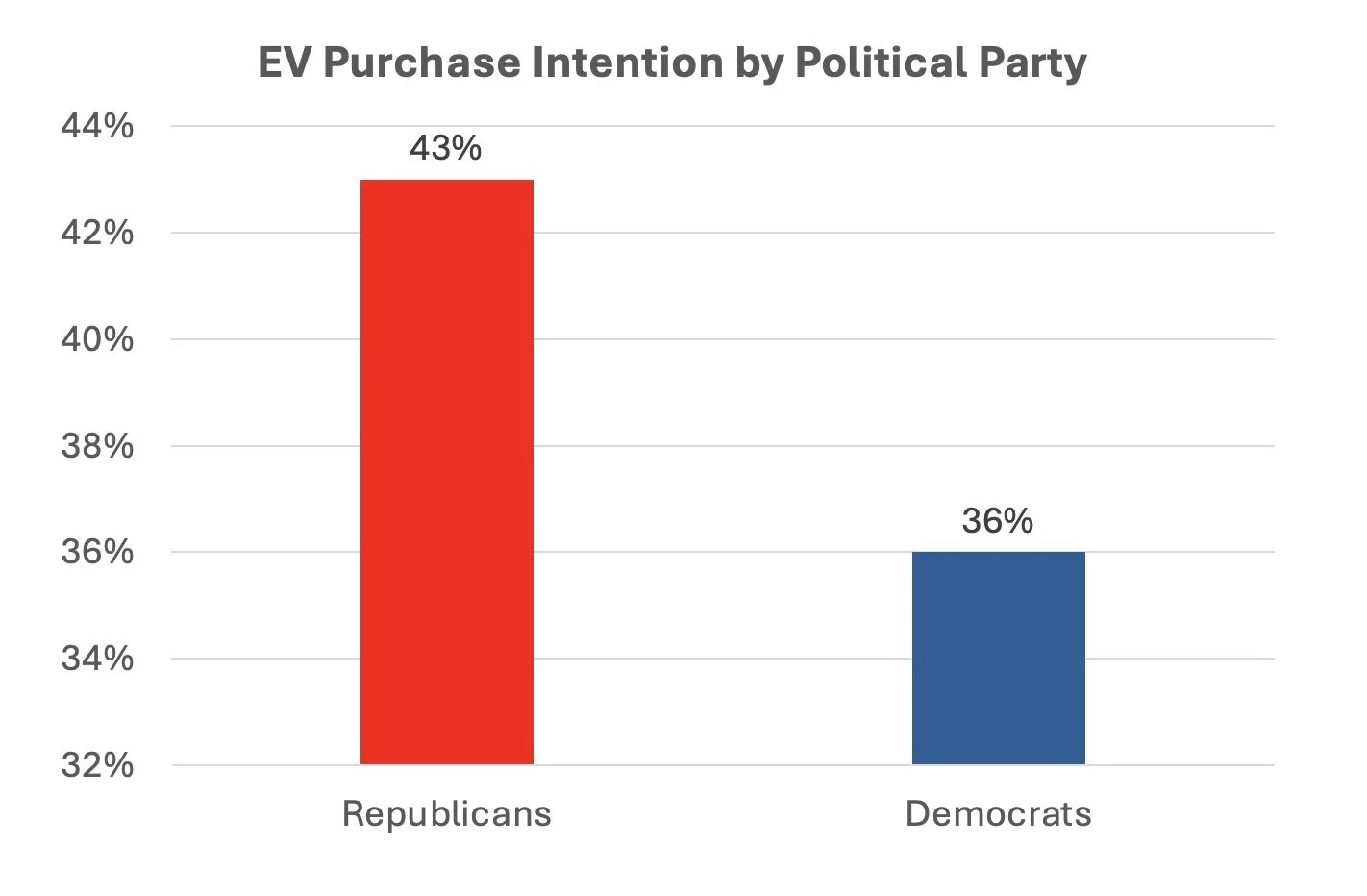

We were a bit surprised to see in our latest Future Attribute Demand Study (FADS) data that EV intenders (shoppers who will not just consider an EV, but actually intend to get one as their next vehicle) are actually now more likely to be Republican than Democrat. Specifically, 43% of EV intenders are Republican while 36% are Democrats. That intuitively seemed strange as so much of the anti-EV rhetoric of the last few years has come mostly from the political right, so we dug deeper into the data to get the real story. And the story has everything to do with Tesla.

While Tesla has been notable for its steep sales declines in 2025, it must be noted that Tesla still accounted for a whopping 44% of all U.S. EV sales in 2025. Some of the sales decline is due to the same pressures that applied to all EVs in 2025, but there is also no doubt that Tesla boss Elon Musk’s very loud and headline-making embrace of extreme far right politics alienated many shoppers and contributed to Tesla’s sales losses around the world.

Source: 2025 AutoPacific Future Attribute Demand Study (FADS)

Digging through our FADS data, we found that 48% of Tesla considerers are Republicans, while only 32% of Tesla considerers are Democrats. While Tesla alienated many potential Democrat customers, the EV maker clearly gained Republican fans in 2025. Indeed, Tesla consideration among EV intenders in 2024 was virtually swapped, with 49% of Tesla considerers who intend to get an EV identifying as Democrats and just 28% identifying as Republicans.

With Tesla’s continued dominance in the EV space, it may very well be that - ironically - Republican shoppers end up being a lifeline for EVs in the U.S. market. With Republicans now dominating shopper consideration for the Tesla brand, and with Tesla expected to remain the dominant leader in EV sales for years to come, it explains why EV shoppers are now most likely Republicans. And contrary to popular perception, politics don’t seem to play much into Republican shoppers’ attitudes towards EVs. AutoPacific’s FADS data show that among Republicans who do NOT want an EV, only 13% say political beliefs are a reason they don’t want them. Rather, cost and charging/range anxiety - the usual EV rejection reasons - top the reasons among Republicans to reject an EV.

So, perhaps the market is actually coming to a point where EVs really are just powertrain options rather than statement pieces. For many consumers - regardless of their politics - an EV is simply what they want or need. For others - again, regardless of their politics - an EV isn’t. Maybe now, it’s really becoming as simple as that.